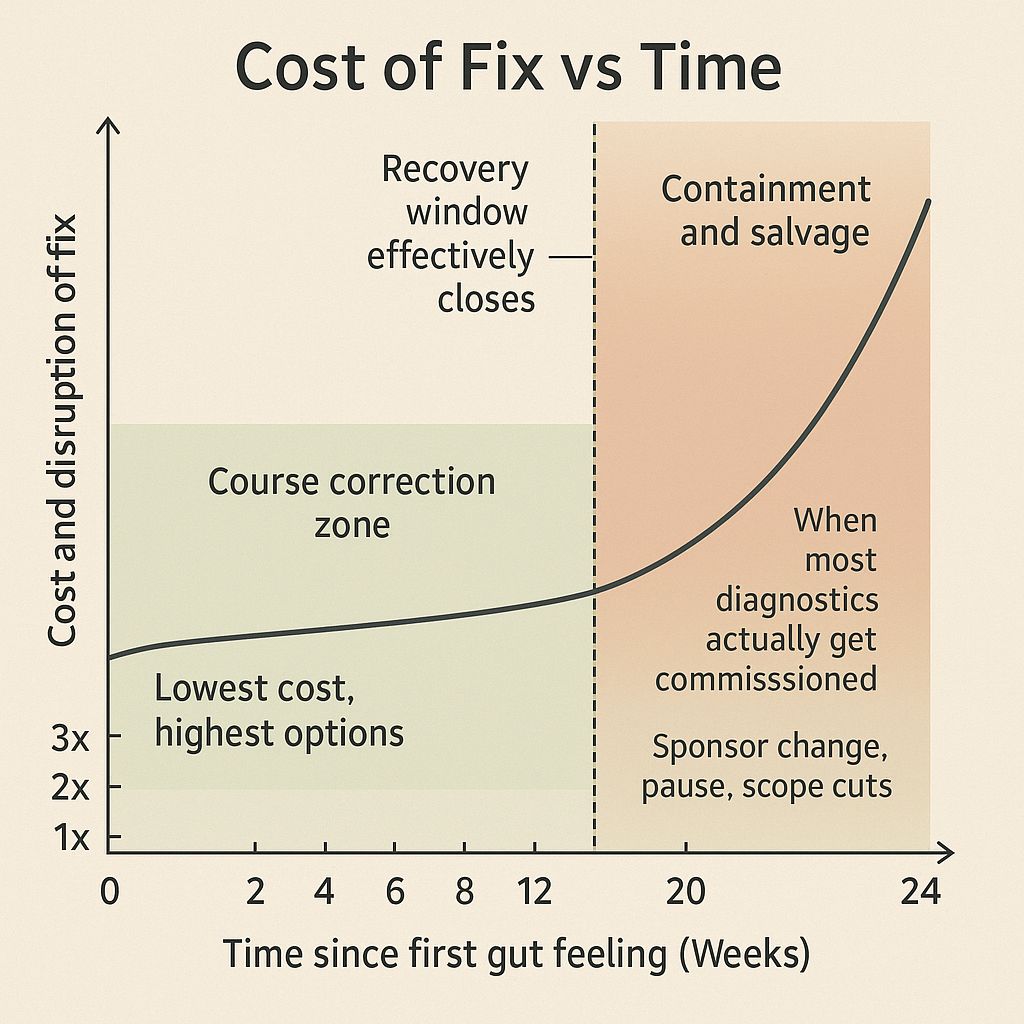

Every Failing Program Has a Recovery Window

Every failing program has a recovery window. Most executives wait until it’s closed. ▪️March: Something feels off. Not wrong exactly. Just off. You[…]

The Theatre of Decision-Making

Your steering committee just approved the business case. Everyone nodded. No one believed it. You know this scene. The 47-slide deck with benefits[…]

The Three Questions Your Board Should Ask Before Approving Any Major Program

You know the pattern. Business case looks solid. Benefits are compelling. Vendor is credible. Board approves. Six months later: “How did we not[…]

You’d Never Approve a $15M Loan the Way You Approve a $50M Transformation. Why Treat Them Differently?

Your organization will spend 6 months assessing a $15M loan. Risk models. Stress testing. Independent credit officers. Loss provisions. Then you’ll approve a[…]

The Two Metrics That Predict Program Failure Better Than RAG Status

our portfolio dashboard shows green. Your risk team is flagging amber. And your gut says something’s wrong. Here’s what you should actually be[…]

How to Tell Your CEO a $50M Program Is Actually Failing (And Keep Your Job)

Your flagship digital program is four months behind and $3M over budget.The PMO says amber. Risk says red. And you’re the one who[…]

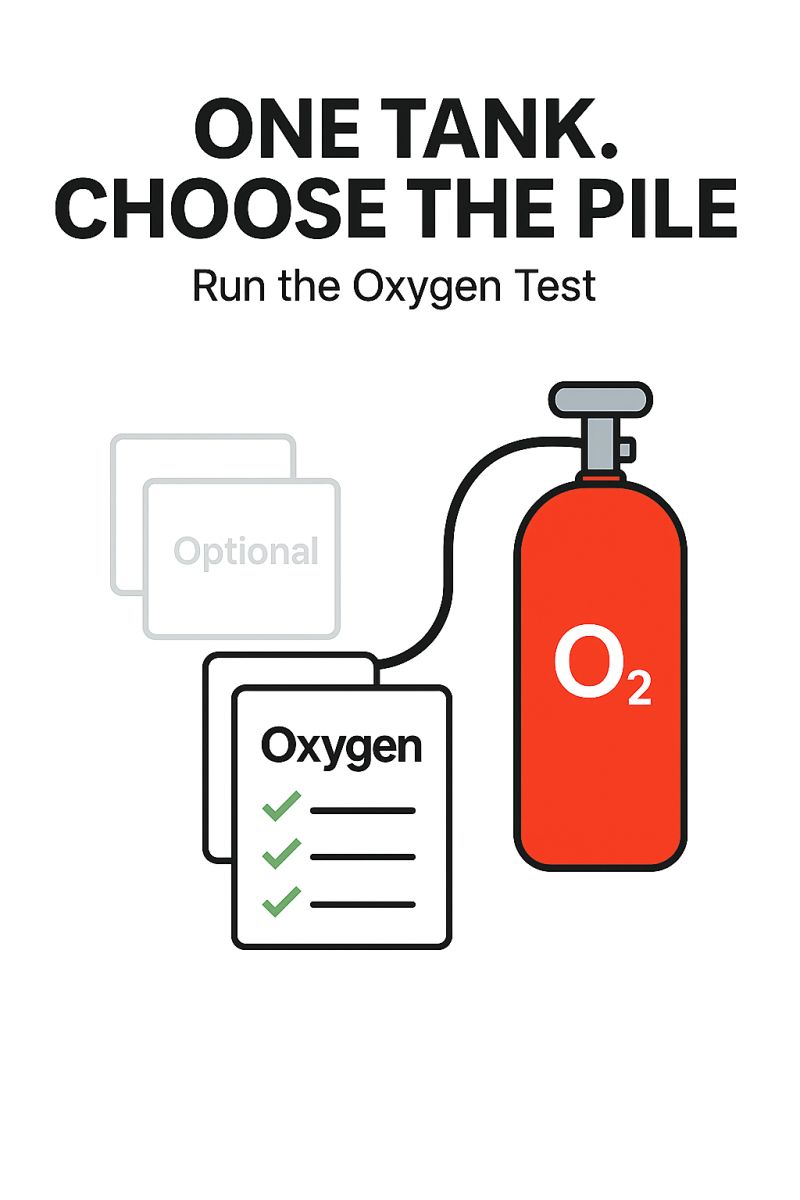

🚦 If everything is Priority 1, Nothing Will Get Done

Most portfolios I see look like a buffet plate at a hungry conference. Twelve must-wins. Four quick wins. Three experiments. Same headcount. Same[…]

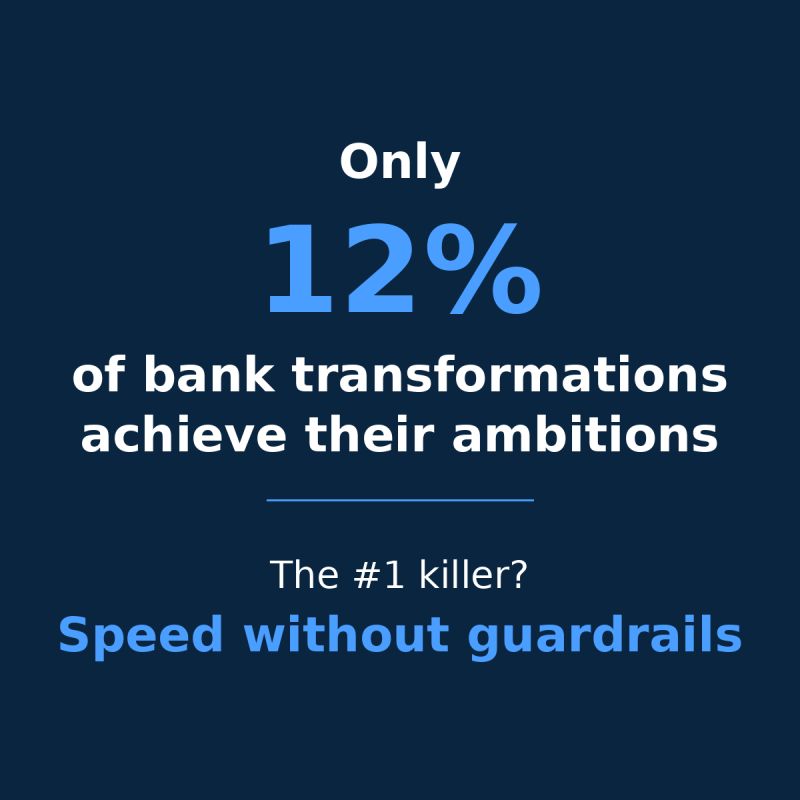

FinTech Fast, Compliance Faster: The 3 Non-Negotiables for Australian Banks

The tension is real. Fintechs and neobanks ship new product features in 2–4 weeks. Traditional Australian banks? 4–6 months. (McKinsey) But here’s the[…]

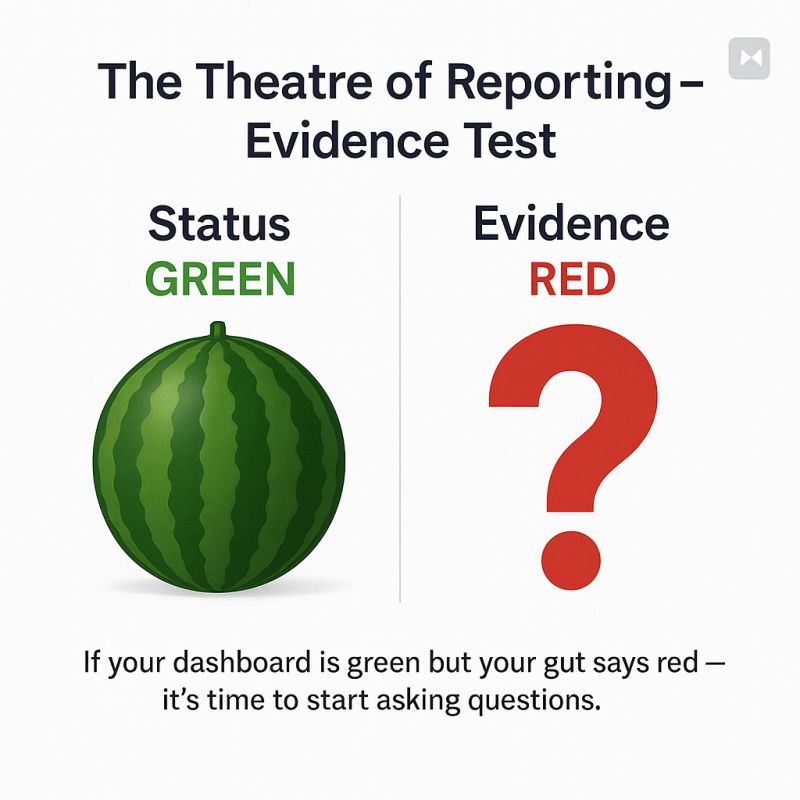

🎭 The Theatre of Reporting: 3 Questions That Stop “Green on Slide, Red in Reality”

If your steering packs feel polished but your gut says “we’re drifting,” try this evidence test next meeting: ❓ Outcome, not activity: “What[…]

🧟♂️ Zombie Projects: Green Status, Dead Inside

You know the type. They shuffle through governance, devour capacity, and somehow never die. They’re not failing loudly enough to stop… just draining[…]